J. Mohorčich is an Assistant Professor in the Department of Political Science at Lehman College, CUNY.

Edited by Jacy Reese Anthis. Many thanks to Rashmit Arora, Rosie Bosworth, and Chris Bryant for reviewing and providing feedback.

Abstract

This paper examines the history of four biofuel firms (KiOR, Amyris, REG, and Novozymes) to draw lessons for the development and commercialization of cell-cultured meat. Findings include the strategic advantage of pursuing high-margin, low-volume products before low-margin, high-volume products, the pitfalls of overpromising with respect to timelines and product, the trap of technological inflexibility, and the way that many different firms pursuing parallel vertical integration strategies can spread fragility within an industry.

Table of contents

Introduction

One constant among the elements of 1914—as of any era—was the disposition of everyone on all sides not to prepare for the harder alternative.

— Barbara Tuchman, The Guns of August

The history of biofuels offers underexplored lessons about what companies should do when they encounter technical problems and cost overruns, particularly when scaling production. Near the end of the 20th century, work to produce fossil fuel equivalents like biodiesel using microorganisms and chemical reactions on renewable substrates like corn and cellulose intensified. Ethanol from corn had been manufactured in the US from the 1970s, but the 1990s through the 2010s saw waves of new biofuel production processes, eventually divided into second, third, and fourth generation biofuels. These generations promised to derive fuel from inedible matter like cellulose rather than edible matter like corn. They also promised higher efficiency, lower costs, improved sustainability, and ease of use. From the mid-2000s to about 2013, biofuels were increasingly seen as a solution to oil shortages and rising carbon emissions. Investment flooded in. By the mid-2010s, enthusiasm and investment had drained away in the face of repeated failures. Talk of fixing the world energy system was replaced by talk of a biofuel winter. The rise and fall of advanced biofuel firms remains one of the most-discussed failures of a sustainability technology. Cultured meat advocates and firms should consider what realistic rearguard action would look like in various bad-case scenarios in which affordable cultured meat takes one to four decades longer than any firm has predicted. Answers to these questions could help mitigate bad-case scenarios. To illustrate the potential impact with some high-level estimates, effective mitigation could mean the difference between, e.g., a 40-year delay in cultured meat adoption (in the event of large overreach, investor flight, and resulting cell-ag winter) and a 15-year delay in cultured meat adoption (in the event that scaling is harder than most firms thought, but a more careful and distributed strategy remains resilient against industry collapse). We estimate the difference between these two scenarios in years of farmed animal suffering to be in the high tens of trillions to low hundred trillions.

This paper examines the histories of four biofuel firms as proxies for wider trends within the industry. I present eight analogies and fourteen disanalogies or differences of unclear sign between the biofuels and animal-free food fields. I offer implications and findings for alternative protein projects on the basis of these comparisons.

Summary of key implications

A summary of implications and findings is at the end of the report.

Biofuel lessons in four companies

This section examines four biofuel companies: KiOR, Amyris, Renewable Energy Group, and Novozymes. Each of these firms offers a different set of lessons from which the cultured meat industry can learn. KiOR[1] is notable for its sharp rise in prominence, inability to realize its technological promise, and rapid decline. Amyris also ran into technical trouble, but managed to stay alive by pivoting to smaller-scale, higher-margin products like cosmetics. Renewable Energy Group (REG) uses a more conservative approach than KiOR or Amyris and remains the largest biodiesel producer in the United States in part because of this approach. Unlike KiOR, Amyris, or REG, Novozymes has not built an end-to-end business model in which a fuel is derived from feedstock and sold to consumers. Instead, Novozymes develops and sells enzymes used in fuel production (among other applications), often to biofuel firms. Novozymes’ lack of interest in producing biofuels in a vertically-integrated way has, somewhat counterintuitively, contributed to the development of enzyme-based fuel production. The achievements and missteps of these firms suggest different paths and pitfalls for cultured meat projects.

KiOR

The technical failure of catalytic pyrolysis

In the second week of November 2014, the biofuel company KiOR filed for Chapter 11 bankruptcy protection in Delaware. From 2008 to 2011, KiOR had been widely regarded as one of the most promising firms working on next-generation biofuels.[2] KiOR proposed to use catalytic pyrolysis to transform biomass feedstock into hydrocarbons to be used as fuel. What would become KiOR’s largest plant, in Columbus, Mississippi, used woodchips as feedstock. The aim, as with many second- and third-generation biofuel ventures, was to produce useful fuel not from edible feedstock like corn, but from the cellulose in waste products like woodchips and cornstalk. Using inedible waste as feedstock sidestepped concerns that crops and land that would have produced food would instead be used to produce fuel.[3] Second- and third-generation biofuel efforts also promised to reduce rather than increase total agricultural waste and to generate lower lifecycle carbon emissions when compared with conventional fossil fuels and first-generation biofuels from crops.

KiOR’s failure, although not unusual in an industry where setbacks have been common, generally arrived as a surprise. How could a publicly-traded company with ample funding, government-backed loans, and a large public offering fail to achieve even a fraction of its yield and cost targets? An unusual amount of information about KiOR’s decline has entered the public record. The state of Mississippi sued KiOR for fraud, the SEC charged KiOR for withholding information about biofuel yields, a group of KiOR investors sued KiOR executives for misleading them, the company’s Chapter 11 filing made thousands of internal documents public, and several highly-placed people in the firm, including those involved with the company’s technology, have since spoken to trade publications like Biofuels Digest about their time at KiOR. The lawsuits have rendered a large amount of documentation public and the interviews with former executives and scientists have led to long, detailed articles about KiOR’s ascent and implosion.

KiOR’s first-choice strategy for converting biomass into usable hydrocarbons ran into early trouble. By the spring of 2008, lab results revealed “excessive amounts of water, coke, gas and char and a relatively small amount of bio-oil that had a low acidity.”[4] Bio-oil was good, but high levels of water, coke, gas, and char were not. Their presence made it harder and less economical to upgrade the bio-oil into usable fuel. KiOR would have to find a way to reduce levels of undesirable material and to increase hydrocarbon output.

Moreover, the proprietary catalyst used in the early tests was expensive. For KiOR to achieve its cost targets, its catalyst would have to be relatively cheap (at least in the low four figures of US dollars per metric ton) and its process would have to use limited amounts of catalyst. KiOR ended up relying on ZSM-5 type catalysts, which are quite expensive (between six and eight thousand USD per metric ton).[5] Weak results with an expensive catalyst were worrying, but not a death knell. It had always been essential to KiOR’s business plan that costs would come down and yields rise as production scaled.

A third and final problem arose as tests proceeded. KiOR researchers found that the yields from their pyrolysis were low, even with high-end catalysts. For KiOR to hit its cost and output targets, it would need to produce more than 60 gallons (~227 liters)[6] of liquid hydrocarbons per ton (~907 kg) of dry biomass put in. In its initial public offering, KiOR estimated its yield at 67 gallons per bone-dry ton (BDT), with a yield target as high as 90 gallons/BDT at commercial scale.

Most early tests found yields in the low 20 gallons/BDT range, and “never above 30 gallons per bone dry ton of biomass,” reported KiOR’s science director, Conrad Zhang, in late 2008.[7] KiOR tried repeatedly over the next four years to bring its yields into the 60-gallon/BDT range. The problem of low yields would precipitate several splits within the company over different technical approaches. On and off, internal splinter groups, convinced KiOR’s main approach, biomass catalytic cracking (BCC),[8] would never produce yields as high as the company needed, worked in quasi-secret on different technological approaches.[9] They hoped to find some alternative process[10] that would improve yields in a way that KiOR’s BCC approach had not.

These attempts failed. Yields never touched 60 gallons/BDT, costs never reached the promised $1.80 per gallon, and KiOR filed for chapter 11 bankruptcy in 2014.

This leads to an important strategic question: to what extent was this failure due to inherent technical challenges of biofuel production versus KiOR’s own mistakes? In his letter of resignation, KiOR board member Paul O’Connor wrote: “The reason for [KiOR’s difficulties], in my opinion, is not because of the failure of the technology itself, but because of several wrong choices made during the development and commercialization of the technology.”[11] In truth, technological shortcomings combined with decisions about how to develop and scale the technology led to failure. KiOR committed a variety of technical and strategic mistakes, particularly during the six crucial years from 2008 to 2013. These mistakes offer valuable lessons for contemporary firms attempting to move technologies from demonstration to commercialization. However, KiOR’s catalytic pyrolysis process failed time and again to produce the results needed. The underlying fact is that positive technical results never appeared in time for KiOR to bring transport fuels to market.

Almost all firms working on cultured meat will experience setbacks similar to KiOR’s at some point. How these firms respond to technical difficulties will determine not only their success but in many cases the success of the technology in question. KiOR was unable to bridge the “valley of death”[12] between demonstration and commercialization. Cultured meat firms will have to learn from the failure of biofuel companies like KiOR to avoid vanishing into the same gap.

Strategic fixedness and overcommitment

KiOR’s researchers and management team were probably less open to alternative technological approaches than they otherwise would have been because they felt pressured to bring products to market quickly. They were also constrained and confused by an inflexible management team prone to infighting. KiOR’s “strategy in rushing towards demonstrating the BCC technology at a multi-barrel-per-day scale,” former Director of Technology Jacques De Deken wrote in 2008, “without corroborating experimental data, under the pretense of self-deception of ‘creating value’, is a recipe for technical failure. Indeed, I do not believe that we currently have the experimental results, catalyst(s) or science base to justify the rush and expense of a [BCC] unit or demonstration... at this time.”[13] As early as 2008, KiOR was overcommitted to one approach, moving too hastily in part because of investor pressure, and unwilling or unable to explore alternative solutions.

By 2010, KiOR’s troubles had deepened. Yields remained low and its biocrude remained acidic and highly oxygenated. In response, KiOR management began to shut out employees critical of the technological approaches favored within the firm. For example, KiOR, when constructing their demo plant in 2010, kept Robert Bartek, De Deken’s successor in overseeing plant design and testing, out of the design loop. While the plant’s development might have run more smoothly in the short term without Bartek identifying problems, the decision eventually led to delays and cost overruns in the demo unit, including having to replace the unit’s main reactor with a different design, an astonishing and costly error.[14] Bartek left KiOR soon after, further weakening the company’s ability to self-correct.

Industry reporter Jim Lane describes these failures on KiOR’s (and other biofuel firms’) part as of a piece with the institutional errors made at NASA in the Space Shuttle era. “The NASA cautionary tale is instructive,” he writes, because “there are correlations between KiOR and [the] Columbia [and Challenger disasters]… Specifically, reluctance to test to understand why systems were not performing in accordance with requirements, organizational barriers that prevented effective communication of critical information and stifled professional differences of opinion; lack of integrated management across program elements; and the evolution of an informal chain of command and decision-making processes that operated outside the organization’s rules.”[15]

One way of promoting institutional structures that can self-correct is to bring engineers into decision-making processes otherwise controlled by non-technical management and investors. For example, in January 2011, Dennis Stamires, a senior scientist at KiOR, wrote in an email that his team was “still looking for a suitable catalyst, hopefully without containing ZSM, or at least a small portion. You can see how frustrated I am , after two or three years and all the work we have done, millions of dollars spent , we are now stuck in a Hole with the ZSM.” That same month, however, “in management circles, there wasn’t a corresponding sense of gloom. In fact, there was a celebration going.” KiOR had taken an important step toward securing a federal loan guarantee, and the management team, which was more concerned with financing than with engineering problems, remained less informed and concerned about technical questions than they should have been.[16] This continued gap between researchers and engineers’ knowledge and the expectations of KiOR management hampered the company’s ability to self-correct.

High levels of stress and fear can stem from technical setbacks, which can further paralyze a firm’s ability to respond. By late 2011, the firm had grown to 160 employees, but KiOR’s low yields seemed as intractable as management's inability to think clearly about them. At this time, “[a] KiOR insider... described... a ‘fearful working atmosphere’.... For employees ‘to survive and keep their jobs, and not being isolate [sic] or fired, they had to remain silent and accept the ‘party-line’ involving the fraudulent and deceiving information fed to the public and investors.”[17] Of course, fraud and deceit were not necessary for KiOR to continue to work on the technical problem of low yields.

It could be suggested that if deceiving investors were to have lengthened KiOR’s runway and this lengthened runway had contributed to solving the technical problems they faced, deception would have to be evaluated as a net positive for the technology’s sake if nothing else. However, KiOR’s attempts to hide its technical struggles stemmed from panic and paralysis rather than from long-term strategy. This same culture of fear fueled KiOR’s inflexibility toward different technical approaches and their hesitance to perform engineering due diligence that would have given researchers the data they needed to discern which approaches and designs would work and which would not. KiOR’s paralyzed response in the face of technical setbacks is evident in the firm’s strategy of refusing to openly acknowledge adverse results, which damaged its ability to explore and fix the technical problems underlying these results.

Investor pressure affected KiOR in a number of ways. In particular, it tended to decrease the firm’s likelihood of conducting engineering due diligence. For example, in the second half of 2008, KiOR was testing different materials and reactor designs for their pyrolytic process. Several researchers argued for conducting a variety of baseline tests to better isolate the effect changes in materials and design would have on later tests.[18] These tests, according to one employee, were not particularly difficult, but would take money and time.[19] However, Paul O’Connor (who would later criticize KiOR management for making decisions like these), CTO at the time, wrote a memo to all staff in September 2008 in which he “objected doing any calibration to establish a baseline,” effectively killing the effort to do so.[20] Lane reports that O’Connor’s “reasoning is not clear,” but guesses that “costs and… timelines, based on KiOR’s timelines to scale and available cash,” played a role. These costs and timelines were, of course, driven by KiOR’s venture capital funders. As KiOR’s problems deepened, its main investor, Khosla Ventures, became more involved in the firm’s decision-making.

KiOR’s “modus operandi was ‘Reckless rush to Commercial,’” recalled senior scientist Dennis Stamires.[21] According to Stamires, KiOR’s haste to commercialize was spurred by venture capital investment. The firm had accepted large investments from biofuel enthusiast and venture capitalist Vinod Khosla, who took an active interest in the firm’s decisions and development timelines. “Khosla and [Samir] Kaul made the important decisions,” Stamires reported, “while Ditsch and Cannon simply executed the orders. And Ditsch, Hacskaylo, Artzer, and Cannon set the [day-to-day] policies, and communicated with the public and investors. The rest of the management team were kept in the dark.” Andre Ditsch, Fred Cannon, John Hacskaylo, and Chris Artzer were all KiOR upper management, whereas Vinod Khosla and Samir Kaul worked at Khosla Ventures. The active involvement of investors in KiOR’s management generated a further split in the company. It meant that when KiOR’s technological development started to run into roadblocks, actors in the company strove to obscure its difficulties not only from the public, but also from other employees in the firm. The involvement of investors and the split between managers who carried out their orders and managers who were kept in dark “created confusion, poor morale, fear, discord, and mismanagement” at KiOR.[22]

In January 2012, Stamires began his efforts to save KiOR by retooling the firm’s technological approach. He quit the management team and “notified the CEO, Fred Cannon, that [he] would devote… [his] time and available resources to developing a new, economically feasible technology capable of meeting KiOR’s business objectives.”[23] Stamires “requested the formation of a task force, called ‘Project Team Oil Yield’, operating separately from Hacskaylo’ R&D group and reporting directly to CEO Fred Cannon, with the objective to introduce in the DEMO Unit and subsequently to the Columbus plant,” a new technological solution for producing hydrocarbons from biomass. Lane writes, “At that time, Professor Vasalos had also agreed to participate. BioeCON founder and former KiOR board member Paul O’Connor was in support…. Stamires recalled that, at the time he explained to CEO Fred Cannon, ‘it was very important to conduct a technology review and assessment in the presence of an Independent expert. It would make the findings and conclusions more credible. It could have convinced the board, and Khosla to act swiftly. It could have saved KiOR.’”[24] It is hard to know whether the matter was as straightforward as Stamires presents it, as people tend to overweight the effectiveness of their own recommendations.[25] However, Stamires’s independent technology group represented a genuine effort to address the core of KiOR’s problems—yields from current cracking technology were too low—and demonstrates one path available to firms who run into deep-rooted technological trouble when trying to scale from demonstration to commercialization. One way of responding to technical challenges is to rethink fundamental approaches, even if large amounts of time and capital have been sunk into the current path. Biofuel firms that failed largely neglected to rethink their technical approaches when their primary approach failed (or they ran out of time and money before they could rethink much of anything). Biofuel firms that succeeded almost always did so because they were able to alter their technical approach, often in tandem with finding a new market for higher-cost, lower-volume versions of their original product.

Over-competitiveness

Often, KiOR and its investors saw themselves as being chased by other biofuel firms. The accomplishments of rivals were used as a spur within the company. In March 2012, Paul O’Connor mentioned in a technology assessment letter to KiOR’s board of directors that his “concerns [about product yields] are further amplified given the fierce, rapidly evolving and well-funded competitive technologies in this space. One example is the [joint venture] between Ensyn and UOP.”[26] But none of these rivals were eventually successful in the way they thought they’d be. Firms perceived themselves as racing toward cheap, sustainable biofuels produced at scale. None of them crossed the finish line. In fact, no one did. The lure of being first to market impeded these firms’ ability to slow down and rethink previous assumptions that could have led to an escape from a technological dead end. This could have saved individual firms and the viability of biofuels writ large. Repeated setbacks, especially when large amounts of time and money have been sunk into a project, can dissuade investors and researchers from pursuing a technology more broadly. For example, because of earlier failures like KiOR, “Capital for commercial-scale biorefineries is still exceedingly tough to find” as of 2017.[27] Avoiding the kind of collapses and disappointments that beset biofuels may help avoid a “cultured meat winter” (analogous to “AI winter”) in which new investment is hard to come by. Technical problems could delay cultured meat for months or years, but industry collapse could delay it for decades.

Management and personnel

In April 2012, O’Connor wrote another letter to the board in which he summarized KiOR’s two main stumbling blocks as a lack of “the people with experience, vision and leadership to move forward with necessary improvements of the technology (yield improvement and catalyst cost reduction) and operations (capacity, ramp-up and time on stream).”[28] Partly this complaint is a reflection of the fact that KiOR’s chosen technology path wasn’t working. There is little evidence that KiOR was working with weak scientists. The firm was hiring top PhDs in physics and engineering.[29] It’s possible that KiOR’s talent pool was slightly shallower than it would have otherwise been because of the decision to site the company in Houston.[30] “By locating in Houston,” Jim Lane writes, “there was a very limited number of qualified technical personnel with the type of expertise needed by KiOR available to be hired, or willing to move to Houston to work for KiOR. Therefore, a lot [of] personnel was hired [sic] who had no experience in the area of KiOR’s business or qualified for the job. Some were friends or ex-colleagues to Cannon and O’Connor.”[31]

O’Connor’s complaint gets at the fact that KiOR was unable to course-correct when their technology wasn’t working. The problem is with “vision and leadership,” not scientific acumen. The technical problems proved to be daunting, but the labor of a dozen more high-end PhDs is unlikely to have mattered. The second part of the complaint gets at the fact that KiOR should have been more attentive to the specifics of scaling up and the personnel needed for such a task. Engineers and operations experts likely should have been involved earlier in the ramp-up process.[32]

In addition to the factors already mentioned (and more outlined in later sections), “most agree that KiOR made poor hiring decisions as it staffed up. The result was a relative preponderance of lab researchers with PhDs and a dearth of people with technical, operational experience running energy facilities.” Fortune reported that “The lack of people with real operational experience ‘hurt KiOR a lot,’” quoting Paul O’Connor.[33]

Additionally, investor involvement gave KiOR the capital it needed to scale, but at serious strategic cost. “The venture capitalists and the executives took another step that would put pressure on the company: selling KiOR stock to the public. That would subject the company to the scrutiny and burdens of the markets and outside shareholders—before it had ever sold a single drop of fuel.”[34] Even before the IPO in 2011, investor pressure affected the company from the very beginning, altering not just tactical decisions but the structure and mission of the firm:

One of the most fateful decisions occurred even before the company was founded. O’Connor was considering licensing his technology to a big oil company. But Khosla—who can be almost as brusque and certain in his conclusions as he is intelligent—disagreed, according to O’Connor. He argued that there was no reason to solicit VC funding if O’Connor planned to sell the technology…. Khosla’s ambition was much bigger. He wanted to make KiOR a producer—a biofuel version of Exxon. That would require massive capital expenditures and huge teams with extensive technical know-how. O’Connor agreed, and says he relinquished a research and development agreement he had struck with Petrobras and stopped pursuing technical discussions with Chevron.[35]

These decisions contributed to KiOR’s financial difficulties and, eventually, to its end.

The end of KiOR

Meanwhile, the alternative technology group within KiOR (the so-called “Stealth team”) was still chipping away at the problem of low yields. In October 2012, “Stamires delivered to Cannon a detailed Technical Report entitled: ‘Proposal for Commercial Use of an Efficient, Cost-effective Integrated Process for the Conversion of Biomass to Liquid Fuels.’” This alternative report represented “a sign of KiOR’s progress from a collaborative group of technologists to a group o[f] fearful employees working in silos.”[36] KiOR was moving toward a model in which they could respond to technological setbacks, try new approaches, and work toward a saleable product.

It would prove to be too little, too late. KiOR continued its slow slide through 2013 until its bankruptcy filing in November 2014. The state of Mississippi’s lawsuit against KiOR alleges five major failings on the company’s behalf, as summarized by Lane:

1. KiOR’s total process yields were not high enough to render the Company profitable.

2. KiOR’s catalyst costs, catalyst replacement rate and capacity creep all contributed to render the Company unprofitable.

3. KiOR did not make a high quality crude oil, but instead made a biocrude that was high in oxygen and acids which made the biocrude difficult to refine within the standard equipment of major oil companies.

4. KiOR had been informed by [Catchlight Energy] and other major oil companies that they were unable and unwilling to refine the Company’s biocrude in quantities that the parties found acceptable.

5. Due to its inability to convince a major oil company to refine its biocrude, KiOR was forced to construct and operate its own refinery in Columbus. These additional costs had not been included in the Company’s financial modeling and projections.[37]

In short, KiOR paid too much for catalysts for an inefficient process that produced poor-quality biocrude and (as a result) couldn’t secure partnerships with established oil companies.

KiOR’s most fundamental problem, however, had to do with its inability to rethink its technological approach. There is evidence that KiOR staff knew about problems with their existing catalytic cracking method from their first tests of it. When these problems deepened rather than resolved themselves with scale, KiOR resisted exploring new approaches (or even widely acknowledging the problem) from a combination of managerial inflexibility, path dependence, and concern about spooking investors, especially after the company's 2011 IPO. As early as 2008, Jacques De Deken wrote that, within KiOR, “genuine efforts to establish a dialog about relevant technical issues have been met with systematic attempts to downplay or dismiss virtually every issue as soon as it is brought up. Clearly, the creation of lasting value is not possible without also developing credible, sound and robust technology. KiOR’s obvious lack of commitment to building a strong and much-needed R&D effort to make this possible is a further indication that KiOR is not really serious about developing successful technology.”[38] De Deken is probably slightly cynical in his assessment of KiOR’s motivations. It is more consistent with the evidence that KiOR was “really serious” about “developing successful technology,” but was unable to do so in part because the technical problems it faced were difficult and because the firm was insufficiently flexible in its approach.

One-pot reactor design

An illustrative example of KiOR’s tendency to wed itself to one technological paradigm appears in one-pot design,[39] an approach popular in biofuels circa 2008. KiOR became attached to the idea even as its shortcomings surfaced:

Members of the R&D team were beginning to see a fatal problem emerging with the one-pot design, in test results obtained at the ITQ Valencia Lab, as well as later on by the tests done at KBR’s Pilot Plant in Houston and subsequently at KiOR’s own KCR Pilot Plant…. The two distinct reactions taking place at the same time (i.e., the physical/Thermolysis and the chemical/decarboxylation/cracking), as it turns out, require individual customized process variables optimizations, and are different for each reaction. So, there’s what one source familiar with KiOR’s process described as “a gross compromise of the individual efficiencies of these two different processes, resulting in a very poor liquefaction and Bio-oil and Bio-oil yield, while a substantial amount of carbon and hydrogen are converted to carbon oxides and water.”[40]

KiOR should have switched to a less-fashionable two-pot approach, but persisted with a one-pot design even in the face of discouraging test results. “[T]here was disappointment in the efficacy of a single reactor to conduct both reactions simultaneously. It’s not surprising given the novelty of running biomass through a[n] FCC reactor, modified or otherwise. Complicated physical and chemical reactions are taking place simultaneously, with side and cross reactions.” KiOR persisted even when “[a] new ‘Two-pot’ system, having individual reactors for thermolysis and for cracking, could have been pursued aggressively at this inflection point [2008-2009]. In fact, Brady, Cordle, Stamires and Loezos filed a patent application on such a KiOR technology, which was granted in 2012,” but this was too late. “Prior to the IPO… steps” toward a two-pot system “were not taken in a systematic way.” Even after the one-pot reactor had been proven ineffective, “the BCC one-pot reactor and the previous catalyst were not discarded... work proceeded exclusively on these systems ‘for over one more year,’ according to one staffer, ‘while delaying KiOR for another year in starting to develop a new feasible Technology.’”[41] This delay burned through KiOR’s runway of cash and time, both of which would have been needed to explore alternative reactor designs. KiOR repeated this error nearly every time they hit a serious technical problem: Management insisted on trying and re-trying a difficult path instead of seeking another way to higher yields, more economical production, increased output. This negatively affected the company, contributing to its eventual bankruptcy, and probably hindered the development of catalytic pyrolysis as a technology.

Amyris

Like KiOR, Amyris began by promising inexpensive, sustainable biofuels from a novel technological process. Like KiOR, Amyris would not produce inexpensive, sustainable biofuels at scale. Unlike KiOR, Amyris still exists (as of early 2019), sells products, and conducts research and development that contribute to biofuel production.

Genetically engineered yeast

Amyris first proposed to use genetically engineered yeast to convert the carbon in plant material into useful hydrocarbons. These hydrocarbons could be used to produce diesel or other transport fuels, as Amyris originally proposed, or they could be used in cosmetics, medicines, and other smaller-scale applications.

While attempting to use genetically engineered yeast to produce biofuel components at scale, Amyris realized that their production process was too expensive and inefficient to scale up into making large quantities of price-competitive biodiesel. Though their biofuels were largely regarded as a technical success, meeting and “exceed[ing] technical and pollution standards,” they remained “commercially.... anything but successful.”[42] After years of research and trying different technical and business approaches, Amyris has emerged as a functional (though not yet profitable)[43] firm selling a variety of products and ingredients based on hydrocarbons produced by yeast. The company’s yeast-produced farnesene is used to make ingredients like liquid rubber, hemisqualane, and squalane prominent in plant-based cosmetics lines like Biossance. Amyris has also “developed yeast strains to produce sclareol, patchouli, bisabolol and one more undisclosed molecule, which based on the company’s shipping manifests is manool. These are all high-value fragrances and cosmetic ingredients, which Amyris produces at low volumes, but sells at high margins.”[44]

Amyris’ roots extend to the early 2000s, when chemical engineer Neil Renninger began working with others, including well-known chemical engineer Jay Keasling, to start a company that would use yeast to produce scarce or hard-to-manufacture substances. Their efforts in 2005-2006 to engineer yeast to produce artemisinic acid, a naturally-occurring compound effective in the treatment of malaria, attracted the attention of the Bill and Melinda Gates Foundation. Artemisinic acid was hard to procure cheaply, because “[o]nly one plant in the world, Chinese sweet wormwood,” produces the substance. This raises the price of antimalarial drugs, which costs lives. Making artemisinic acid “in vats with bioengineered yeast would make the drug cheaper” than harvesting it from wormwood. Some estimated that wider access to artemisinin (the drug derived from artemisinic acid) could save 655,000 lives per year. “The Bill and Melinda Gates Foundation,” journalist Daniel Grushkin writes in an extensive Fast Company article on Amyris’s rise and fall, “then already campaigning worldwide to eradicate malaria... granted $42.6 million to the Institute for OneWorld Health, which then partnered with [Jay] Keasling’s students. Renninger still has the wire statement for the first $3.7 million. It had more zeros than he had ever seen on a check, and it was made out to a mostly nonexistent biotech company that he and his friends had called Amyris.”[45]

Amyris’s scientific accomplishment was significant: “In March 2006, after two years of work, Keasling, Renninger, and the team had engineered the right combination of gene parts. Nothing like it had ever been done. By way of comparison, Monsanto, which has a billion-dollar research budget, has only ever commercialized a corn strain with eight new genes; Amyris had engineered 13 into yeast.”[46] Yeast-produced artemisinin was a scientific success[47] but produced no direct profits for Amyris. Keasling’s lab at UC Berkeley had granted a free license to Amyris to use their artemisinin yeast technology on the condition that the company did not sell the drug at a profit in the countries that most needed it.

“Set your sights on diesel”

Around this time, Vinod Khosla (the main investor in KiOR) told Amyris: “Set your sights on diesel... It’s the hardest thing you’d want to do, but it’s the biggest market out there, and you’ll build an incredible company.”[48] For an ambitious biotech firm like Amyris, “[f]inding an alternative to petroleum had the same ring as battling malaria: The world would be better for it.”[49] Khosla’s advice to Amyris echoed his advice to KiOR to become “a biofuel version of Exxon.”[50]

Amyris “debated making lubricants and high-value chemicals for perfumes. All of these, however, seemed to lack the nobility of battling malaria.” Biofuels seemed benevolent and high-impact, so Amyris became more interested in them during 2006 and 2007. They aimed to engineer yeast to produce farnesene, a group of chemical compounds that can be “converted to a diesel-like fuel without any apparent downsides.”[51] Amyris planned to build a plant in Brazil and use the country’s cheap sugarcane as feedstock.

Early results were encouraging. Amyris “had begun to demonstrate that its farnesene, when developed into fuel, met or surpassed industry standards. General Electric and Embraer, the Brazilian airplane manufacturer, tested Amyris’s jet fuel and found it no different from regular fuel. Mercedes took sample orders for diesel. They too said it was nearly identical.”[52] The firm had raised $156 million from private investors, but scaling would require more capital. The board decided to take Amyris public and the company planned an initial public offering for late 2010.[53]

Even before it was held, the IPO made Amyris accountable to investors and markets in a way it had not been. When CEO John Melo announced in September 2010 that “his ‘no compromise’ fuel could be poured straight into tanks without having to retool engines [and] promised that by 2011, Amyris would produce 6 million to 9 million liters of farnesene, and another 40 million to 50 million liters by 2012,” these statements “started a clock.”[54] Amyris now had technical targets to which it was publicly accountable.

Neil Renninger describes “Melo’s promise [as] the tragic misstep of Amyris’s young and turbulent life.” He argues that Amyris’s “problems are not problems of technology but problems arising from the pitiless expectations of Wall Street. ‘We were chasing that number,’ Renninger says of the 50 million liters [Melo had promised by 2012]. Amyris would have to meet the quotas Melo had presented or lose credibility,” which for a publicly-traded company could lead to a falling stock price, lawsuits, and SEC charges (as KiOR would soon be able to attest). Part of Melo’s ambitious targets resulted from a failure to anticipate the difficulties of scaling a production process built on a new technology. “Coming from the petroleum industry,” Grushkin writes, Melo viewed targets like 40 to 50 million liters “as laughably small.” But “Amyris was not an oil company, and it still didn’t have a full-scale plant. ‘The regret is not realizing how hard it was to get the scale up,’ says Melo now. He soon discovered it would take a lot longer for a fermentation and manufacturing system to work than his team had estimated.”[55]

A class action suit filed against Amyris and Melo in 2013 by investor David Browning alleges that Amyris’s misunderstanding of the difficulties that would come with scaling were both more pervasive and intentional than Melo and industry reporting lets on. Relying on an Amyris employee referred to in court documents as CW, the suit alleges that “estimates by Amyris scientists were that the Company’s capability to produce commercial Biofene [Amyris’s brand name for their farnesene] was roughly ‘five fold lower’ than what the Company was publically projecting…. the Company’s management was aware that it would not be able to translate peak yields of Biofene, produced in lab settings, to stable and reliable production at factory scale.” The suit notes that it

is widely known in the industry, and was known to Defendants during the Class Period, that scaling biofuels is a massive engineering feat that requires fine-tuning to maximize performance. Unlike some industries where being first to market is advantageous, in renewable energy, there is often a first mover disadvantage because scaling the initial technology for commercialization is as difficult (or more so) than proofing the technique in the lab.

Moreover, “CW believes that Amyris management, including CEO John Melo either… ignored its scientists’ realistic recommendations concerning projections of yield, or cherry picked the… best available data from tests at every step of the process, then accelerated that data based on knowingly unrealistic projections in technological advancement to create numbers for the projected yield that they disclosed to investors…. CW states that the only way Amyris’ 2011 projections numbers of 6-9 million liters of Biofene production could be justified was to make assumptions beyond the ‘state of the art’ technology.”[56] (The quoted document, a class action complaint, has an incentive to retell the Amyris story in as negligent terms as possible, just as Melo has the opposite incentive. The suit was dismissed in March 2014 by a California judge for lack of particularity, a legal term that means that its claims were not specific enough.) In any event, Amyris’s manufacturing process would take much longer to bring online and costs would prove far harder to bring down than Melo and Amyris had anticipated.

Scaling and timeline issues

In their 2010 IPO presentations, Amyris projected that their biobased farnesene would be cost-competitive with conventional petroleum as they scaled up. The path toward cost-competitiveness involved scaling up production by building a plant in Brazil fed by sugarcane.

Amyris at first rented a hangar in São Paulo and set up two fermenters, each two stories tall.[57] By June 2011, this facility was operational but “beset with problems.” Occasionally, “the process worked as it had in the California labs. Other times, the enormous tanks frothed with the carcasses of exploded yeast cells.”[58] Amyris faced recurring problems with both the changed environment (yeast cells are living organisms and remain sensitive to their living conditions) and the problems, new to most of the team, of scaling up production plants.

Meanwhile, public pressure mounted on Amyris. In the five months following Amyris’s IPO, the stock price had increased from $285 per share in October 2010 to $500 per share in February 2011. After the IPO, Amyris “announced 20 collaborations with major chemical and commodity companies around the world. ‘We led the IPOs, the first one out, and we were viewed as a leader in this industry,’ Renninger recalls. ‘I remember going to a conference in San Diego in January and having people come up and say, ‘Hey, realize that we’re all depending on you. If you guys don’t succeed, we’re not going to have the opportunity.’”[59] When the São Paulo hangar came online in July 2011, the stock had cooled to $399. As production problems mounted, Amyris stock underwent three major slides, in July and August 2011 (down to $280), November 2011 (to $151), and February 2012 (to $73). It would eventually bottom out around $2.50 in 2017.[60]

As with KiOR, yield issues contributed to Amyris’s falling stock price and rising pressure on management. “Theoretically,” Amyris’s yeast “could convert 27% of the sugar it digested into farnesene.” Amyris, however, “was struggling to make a strain that yielded more than 20%.”[61] Moreover, costs for what they did produce were too high:

In 2011, the company entered into contracts to supply its sugar-cane derived diesel to the transit authorities for use in buses in Rio de Janeiro and São Paulo. At an exorbitant cost of $7.80 per litre, this required a significant public subsidy…. [But] even this was well below the cost of manufacture. Thus, the more farnesene-based diesel Amyris produced and sold, the greater the company’s losses were…. Amyris’s directors had been hoping from the outset that their company could sell farnesene at its real production cost of $20 – $50 per litre, or $3,180 to $7,949 per barrel, which would mean selling it for use in expensive, niche products.[62]

The plaintiffs in Browning v. Amyris rely on a chemical engineering paper, their CW informant, and a team of consultants to argue that four main technical problems beset Amyris: metabolic flux, metabolic burden, genetic instability, and contamination. Metabolic flux describes how rapidly molecules move through metabolic networks and can lead to “bottlenecks as a result of flux imbalances, which lead to the diversion of molecules away from the desired product. The accumulation of toxic intermediates can thus occur. This is particularly problematic when several different enzymes, which may be derived from different organisms, are introduced into one cellular host.” Metabolic burden refers to how an “overproduction of non-essential proteins may trigger stress responses within the cell and slows its growth.” Genetic instability describes a situation “where the metabolic burden ‘shouldered’ by a plasmid-bearing or transgenic producer cell places it at a disadvantage relative to a nontransgenic nonproducer cell, which leads to genetic instabilities in the engineered cells. Genetic instability can be mutation in either the transgene or the plasmid DNA vector, as well as losses of plasmid DNA vector. This may be present when an increase in cell growth is seen, while product titers decrease.” The complaint identifies what “appears to be the introduction of extraneous microbes by contamination” as the final technical cause of Amyris’s scaling trouble.[63] At one point, the Brazil plant had been so “poorly designed and constructed… that it needed to be retrofitted to reduce major problems with cross-contamination by foreign yeast and bacteria.”[64] (Even in well-designed production facilities, contamination by foreign agents remains a concern for biotech firms of all types, as E. coli outbreaks on hydroponic farms have shown.)[65]

Amyris also probably tried to scale too fast. In an effort to meet its production targets, the company attempted to “create several other manufacturing facilities, including a second plant in Sao Paulo in conjunction with a small sugarcane mill called Paraiso Bioenergia.” Amyris’s attempt to get their main plant working while also bringing other plants online compounded rather than repaired their mistakes. “Given a chance to do it over again,” Melo said in an interview with Fast Company in 2012, “I would focus on our Paraiso plant and getting that one up and not all the others.” Jay Keasling agreed, telling the same reporter: “[m]aybe [Melo] could have been safer. Maybe he could have just done one facility at a time. I don’t know a lot of the thinking that went into it, because that was kind of beyond my time. I’m not a business guy; I’m a science guy. So maybe hindsight is 20/20.”

Consultants retained in the Browning suit suggest that Amyris’s difficulties scaling up also

appear... to be caused by a violation of the 10x (10 fold) rule. Consultants believe standard chemical engineering rules dictate that no process should be scaled at levels beyond 10x volume or weight. Consultants’ review points to the Amyris stated levels of scale were as follows:

Research used 2 liter fermenters.

The Emeryville Pilot plant used 300 liter, as well as the pilot plant in Campinas, Brazil.

The Demonstration facility used 5,000 liter (Campinas, Brazil).

Contract manufacturing showed in company literature that 60,000 to 200,000 liter vessels (reactors) were used and the “Capital Light” production presented a JV design at 600,000 liter.

Under standard chemical engineering models 10x (10 fold) scale, the lab would be 2 liter, the pilot would then be 20 liter, the demonstration units would be 200 liter while the full scale would be 2,000 liter…. based on what was known at the time, Amyris’ projections were unreasonable.[66]

Melo’s promises of producing six to nine million liters in 2011 and forty to fifty million liters by 2012 were made in 2010, when Amyris had its Campinas facilities online and therefore possessed a production capacity of about 5,000 liters. It was proposing something like a 1,500-fold increase from 2010 to 2011 and a 9,000-fold increase from 2010 to 2012. If Amyris had retained their 40-50 million liter target, but pushed the date out in accordance with standard 10x scaling models, their ramp would have looked something like: 50,000 liters in 2011, 500,000 in 2012, five million in 2013, and 50 million in 2014. This would itself have been hugely ambitious: order-of-magnitude increases every twelve months with no serious delays is the kind of thing common to IPO prospectuses but rare in reality.[67] Assuming more conservative twenty-four month steps, Amyris would have reached 50 million liters in late 2018.[68]

Even if Amyris could have climbed these slower production ramps without running into intractable technical issues, it’s not clear that investors would have been patient with such long timelines. Like chemical engineering, venture capital and startup communities talk about growing by orders of magnitude, but these ideas do not resemble the growth models in chemical engineering. Venture capital models emphasize speed, focus on individual factors like effort rather than physical constraints, and advise courses of action like

every time you have to make a hard decision, ask yourself this question: ‘Is this going to propel the company, person, or project by a factor of 10?’.... Once you've found your next big 10X thing, then double down. If you know that this is a game-changing ‘massive action’ that will drive significant results for your business, it requires 2,000 percent of your time, energy, and focus.[69]

Investor beliefs about what rapid growth is and how it is best achieved remain at odds with chemical engineering models of scaling.

Investors are sometimes willing to show patience, even with publicly-traded companies (while the story that Amazon has never turned an accounting profit is folklore, the firm took more than a decade to achieve consistent profits[70]), but this patience often results from a particular set of circumstances and interactions between companies and investors.[71] Choices within a company’s control include management being forthright about the fact that profitability is a long-term question and that years of development and scaling may come first and at great cost. It is difficult but probably advisable to avoid promising an aggressive ramp-up that brings immense profitability in a short period of time. It remains the case that even the most talented companies cannot outrun physical constraints and the technical problems that emerge within complex systems.[72]

Counterfactuals

It is impossible to know the counterfactual case of a slow-burning, careful KiOR or Amyris. Amyris’s pivot to non-biofuel products on a modest scale (but still sufficient to sustain its research and development efforts) suggests that a slower, more careful approach that focuses on high margin applications while the technology is still expensive may one day lead to a technology that works at scale.[73] Amyris presents a potential example of how to carry a technology forward even when its main application has failed. “Amyris has trademarked the phrase No Compromise,” Lane wrote in 2018, “but of course the entire company’s mission is a compromise and in fact it is the source of Amyris’ strength, it[s] ability to adapt to changing conditions and find new ways to pioneer when the expected pathways to success turned out poorly for them.”[74]

The consultants retained in the Browning suit argue that Amyris’s business model “at inception was appropriate had they had remained focused on small scale biological products for malaria and related biotechnologies for human and veterinary diseases, as Jay Keasling… did by licensing the Artemisinin-based anti-malarial technology.” Amyris didn’t, however, even though “based on the existing state of technology during the Class Period, they could not have reasonably projected [their publicly] stated projections for production in biofuels.” Amyris’s move away from riskier, capital intensive moonshots like biofuel production likely saved the company and kept money flowing into engineered yeast research that would have otherwise have gone elsewhere.[75] It represents one potential model for cultured meat firms if early targets, especially with respect to cost and volume, prove more difficult to reach than initially thought.

REG

Renewable Energy Group (REG) is, as of late 2018, the largest biodiesel producer by volume in the US. REG uses a transesterification-based process to turn feedstock like inedible corn oil, used cooking oil, and animal fats into biodiesel.[76] REG also sells byproducts from their biodiesel production process like naphtha and glycerin. The company operates 14 refineries and a feedstock processing facility.[77]

The firm’s basic business model appears to be profitable even after subtracting subsidies and tax credits.[78] REG has bounced between profit and loss over the last five years, reporting an operating income of negative $89.8 million on revenue of $2.16 billion in 2017, down from an operating income of positive $64.5 million on revenue of $2.04 billion in 2016. In 2018, the firm reported an operating income of $322 million on revenue of $2.38 billion.[79]

REG’s story does not resemble those of Amyris or KiOR. There are no high-profile lawsuits, glaring management errors, or jilted investor groups. The firm has its roots in an Iowa-based company, West Central Cooperative, which began experimenting with biodiesel production in 1997. REG was spun out of West Central as a biodiesel venture in 2003[80] and began to pursue a strategy marked by the transesterification of cooking oils and plant acquisition. Transesterification, a process common to biodiesel production first documented in 1853, benefits from technological advances, but does not depend on them to become viable the way genetically-engineered yeast or new types of pyrolysis do. REG’s technology risk is therefore lower, although its eventual technological ceiling may be lower as well given that transesterification has been refined for 160 years and few step changes in efficiency remain to be found.

REG is known for being “allergic to hype.”[81] Unlike other biofuel firms, which have acquired a reputation for promising production numbers and cost reductions that they then fail to meet, REG tends to make conservative projections that it often beats. REG tends, as industry observer Maxx Chatsko notes, to “set a low bar and leap over it.”[82] The epigraph for the company’s own promotional history lacks ornamentation or soaring promises: “methodically” is the only adverb.[83]

Should cultured meat firms pursue a low-hype strategy? The stories of Amyris and KiOR suggest that high levels of publicity attracted investment but also contributed to the firms’ accelerated schedules and eventual setbacks.[84] REG, a more successful biofuel producer than Amyris or KiOR, is sufficiently committed to maintaining a low profile that public discussion about it is remarkably low: it produces a lot of biodiesel, turns a profit most years, and doesn’t make big promises.

It is impossible to know the outcomes of different counterfactual scenarios, of course. If REG had promoted itself and its technology more aggressively and attracted larger and more prominent investment than it otherwise did, would the firm be making more biodiesel at lower cost today? The evidence from biofuels indicates that slower-growing, conservative, low-hype firms are better able to withstand downturns and tend to survive longer, produce higher volumes of product, and contribute more to research and development over longer timelines than do rapid-growth, high-publicity firms.

A final example of a successful conservative firm is Novozymes.

Novozymes

The Danish firm Novozymes is older than most biofuel-related firms. It was spun out in 2000 from a series of predecessor businesses dating to the efforts of Harald and Thorvald Pedersen to produce insulin in the 1920s. Novozymes has from its inception specialized in enzyme research and development. Today, its website reports that it is responsible for two thirds of the world’s investment in enzyme research.[85]

Enzymes are quite important in biofuels. For example, enzymes represent between 13% and 36% of the “cash costs” in cellulosic ethanol production.[86] Novozymes seeks to capture a large portion of enzymes’ “cash cost” by selling them to biofuel firms. Instead of using a vertically-integrated business model, Novozymes positions itself midstream in the biofuels supply chain. It primarily develops and sells enzymes to other biofuels firms. Novozymes, therefore, is not organized around a lab-to-consumer model. The firm does not purport to develop novel production processes in its labs, scale them up, and produce biofuels or other lipids at commercial scale. The lab-to-consumer model remains prevalent among both biofuel companies (particularly early, more ambitious biofuel companies) and cultured meat startups and widely covered in the press compared to other firm structures. Alternative ways of organizing a business, therefore, can be non-obvious, even though they remain common in established industries like oil and gas.[87]

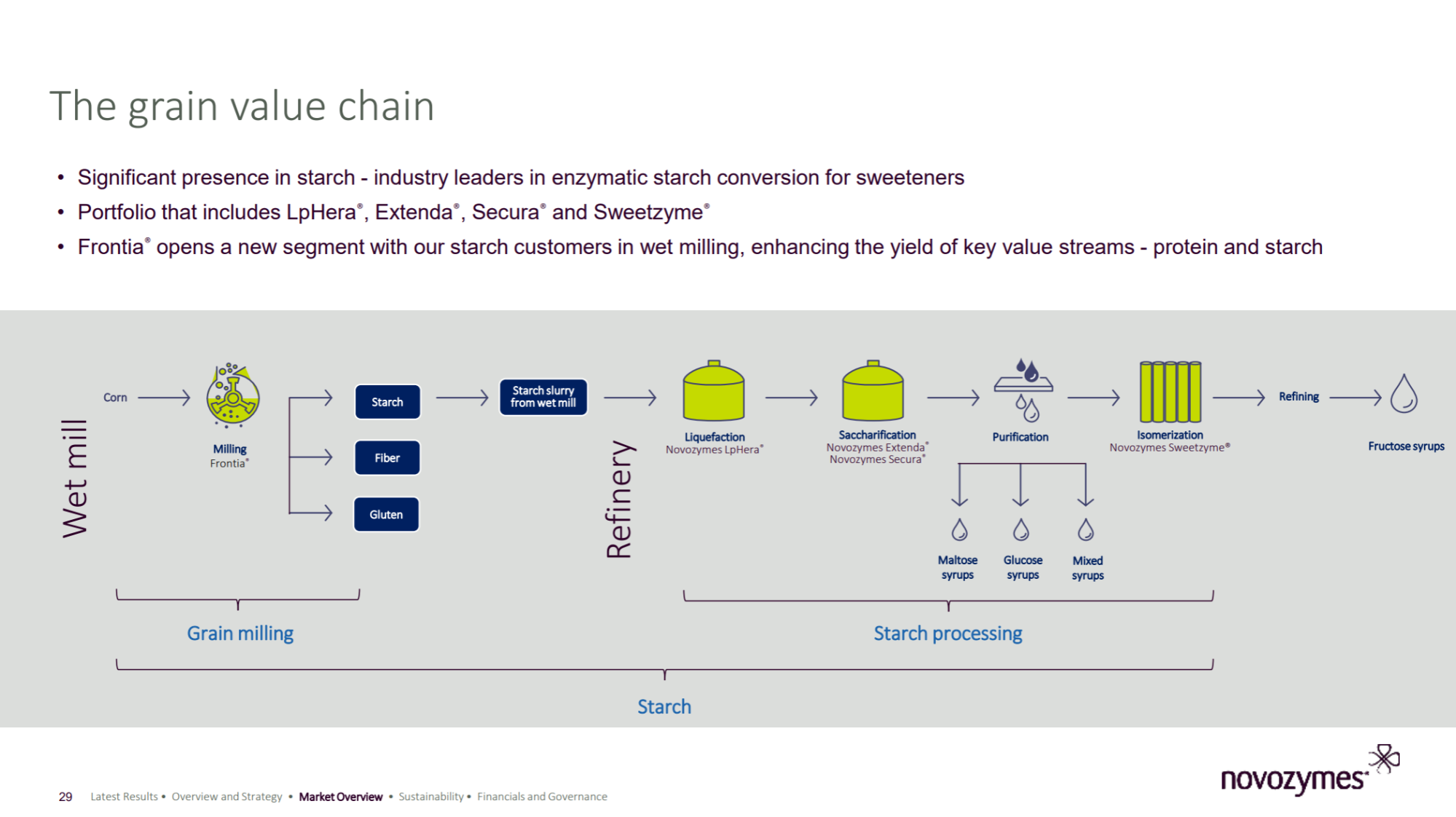

Fig. 1. Novozymes’s role in grain milling and starch processing. Lime-colored illustrations represent places in the value chain where Novozymes enzymes can be used.[88]

The enzymes Novozymes develops and markets can be used, for example, to improve starch extraction from corn, to convert cellulosic material into sugars and alcohols (including ethanol), and as an additive in detergent to catalyze reactions that break down proteins, starches, and fats.

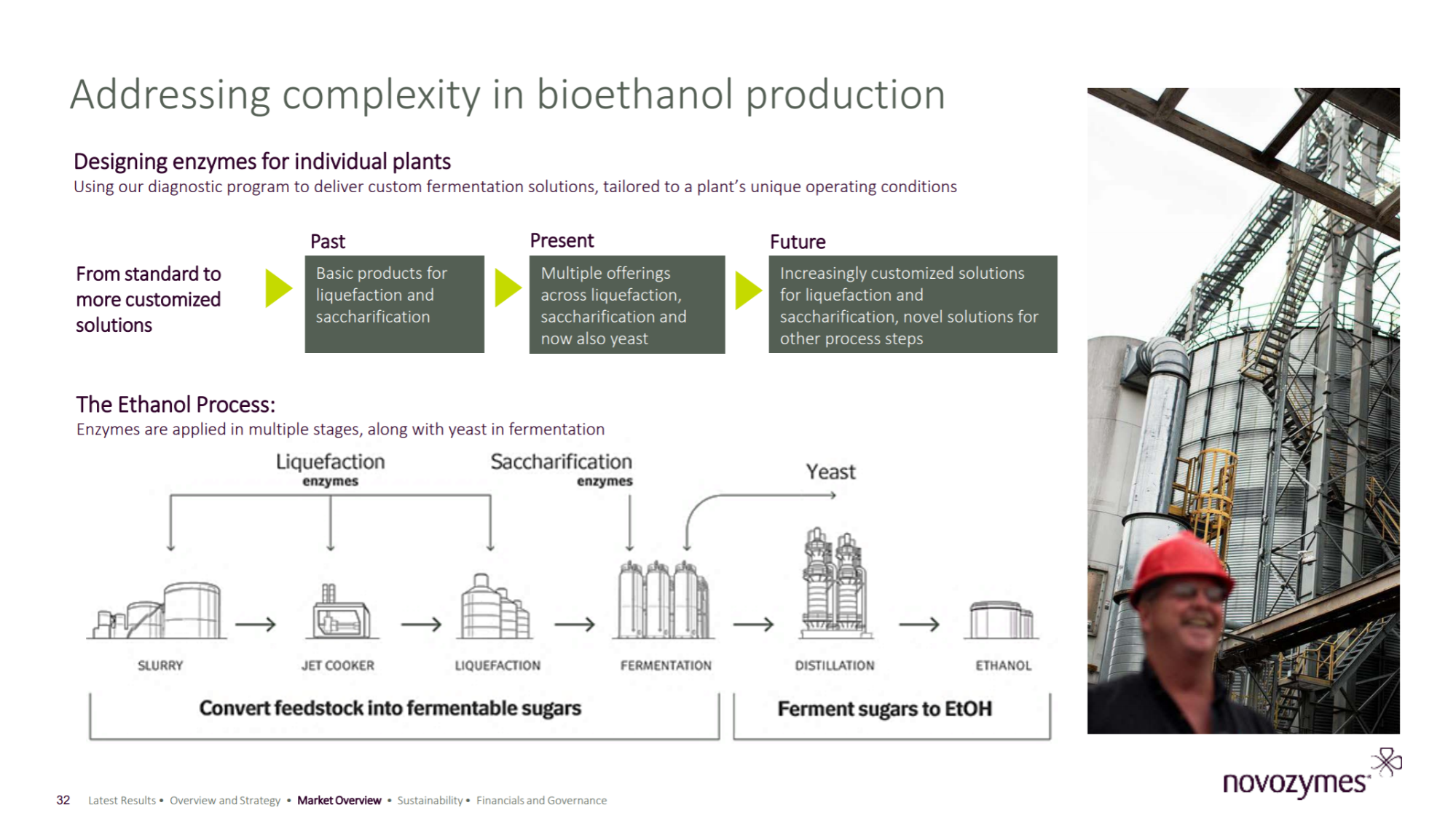

Fig. 2. Novozymes enzymes aimed at ethanol producers.[89]

By participating in the biofuels market as supplier of enzymes rather than as a vertically integrated producer, Novozymes was able to weather several rounds of bankruptcies and crashes in biofuels from the 2000s through the mid 2010s. The firm was able to contribute technologically during adverse conditions for biofuel firms. For example, in 2013, in the midst of a biofuels shakeup precipitated by technological failures to increase yields and reduce costs, Novozymes introduced a new enzyme mix that “boost[ed] yields to 2.9 gallons [of ethanol] per bushel” of corn (from 2.77) and “add[ed] 13% yield in corn oil extraction while dropping energy usage.”[90] This had the effect of both continuing Novozymes’s presence in and development of biofuel production and contributing to cost decreases for ethanol production rather than folding, being acquired, or withdrawing from biofuels as did so many other firms in the 2000s and 2010s.[91]

Novozymes’s history suggests that an established firm’s presence in a supply chain may increase the resilience of the industry built around that supply chain. It also implies that occupying one well-defined position in a supply chain can render a firm more resistant to downturns. Finally, it suggests that a supply chain made up of different contributing companies can lead to more resilient, technologically-robust industries than when many firms try to create siloed end-to-end processes.

Likely analogies between biofuels and cultured meat

Expensive products were feasible, but higher volumes and lower costs were not.

Consider the difference between commercializing expensive high-end cultured meat products and commercializing mass-scale cultured meat products that are cheaper than slaughtered meat. Expensive products will happen in a relatively soon (as early as 2019) timeframe. Mass-market products lie much further along the experience curve: High-volume cultured meat will take far longer and require more engineering advances and cost reductions than early products.

Cultured meat production, at this early stage, is most similar to areas like biofuels or algae in the mid 2000s, which would go on to produce expensive products for a niche market while the chasm to more ambitious applications, e.g. replacing all oil or factory farm production, remained unbridged by existing industry or firm structures. (This gap between demonstration and commercialization is sometimes called the “valley of death.”[92]) The initial goal remained possible but often required far more money and patience than was ever predicted. In practice, being mission-driven may not mean moving at breakneck speed, but instead moving somewhat cautiously, preferring slow burns and long-term projects where they might otherwise be inclined toward rapid expansion and aggressive gambles.

Firms often pursued low-margin, high-volume products when it was more advantageous to pursue high-margin, low-volume products.

Biofuels firms often took wing on the promise of cheap, sustainable fuel for the world. James Collins, professor of biomedical engineering at Boston University, suggests in an interview with technology reporter Martin LaMonica that “while the science behind biofuel companies was promising, ‘in most cases, they were university lab demonstrations that weren’t ready for industrialization.’” Collins argues that “We’re never going to have biofuels compete with $20-a-barrel oil—period… I’m hoping we have biofuels that compete with $100-a-barrel oil.”[93] Researchers knew early on that hydrocarbons could be made via exotic methods like engineered yeast and cellulose pyrolysis, but it took biofuel firms more than a decade to discover that they could not be made as cheaply as oil could drilled, at least without significant technical advances. They could not be price-competitive with retail gasoline, but they could be price competitive with cosmetics and medicine.

The lesson for cultured meat is to start with products that are more expensive, especially those with high production costs. Adam Flynn, CEO of Forelight (which is working on a fungible protein replacement for blue dye no. 1), points out that insurance companies could effectively pay thousands of dollars per kilogram for a mature cultured collagen product if it is used to make replacement intervertebral discs, but collagen used for meat has to compete with steaks that are $19/kg.[94]

In the cellular agriculture industry (this includes companies developing cultured meat but also dairy, eggs, and other animal products made without animal farming), at least one company based in California, Geltor, is already commercializing recombinant animal proteins at high prices in a niche market. Geltor’s core product, collagen made with genetically engineered yeast, was first sold for pharmaceutical applications in 2017. It was sold at a much higher price point than the collagen used in gelatin for food, but the pharmaceutical industry prizes high-quality, homogenous product, which is more easily produced with cellular agriculture.[95]

Another company, Finless Foods, based in California, has argued that a focus on expensive fish products like bluefin tuna, which sells to restaurants for over $300 per kilogram at high-end auctions and for about $40 for farmed bluefin, sets a more attainable price target than a focus on inexpensive products like ground beef, which wholesales closer to $3.50/kg in the United States.[96]

The most prominent biofuel startups focused on vertical integration and consumer products rather than business-to-business sales.

The history of Novozymes, Amyris, REG, and others suggest that cultured meat firms should not neglect business-to-business sales.[97]

The cultured meat supply chain is still emerging. As it does, different places to contribute will develop. Right now the majority of cultured meat companies are focusing on a vertically-integrated brewery-to-supermarket model. However, many biofuels firms were able to contribute to biofuel development after their own attempt at the popular model of feedstock-to-gas-tanks had fallen short by specializing in business-to-business products and/or technical contributions like converting “first-generation ethanol and biodiesel plants into advanced biorefineries.”[98] See, for example, REG’s interest in plant design and acquisition and Novozymes’s development of Fermax, a compound that reduces foaming in cane ethanol production.[99]

As discussed earlier, KiOR had a chance to diversify but chose to go with radical vertical integration instead. “O’Connor was considering licensing his technology to a big oil company,” but Khosla, KiOR’s primary investor, opposed a B2B strategy. He “wanted to make KiOR a producer—a biofuel version of Exxon.” Khosla’s view won out. O’Connor “relinquished a research and development agreement he had struck with Petrobras” and ended “technical discussions with Chevron.” This decision almost certainly left KiOR and the biofuels industry worse off than if KiOR had tried a different strategy.

Additionally, there may be advantages for a technology in general by having many firms positioned along the supply chain. In biofuels, firms can, out of pure self-interest, sell enzymes or license technologies to each other that make other firms’ approaches work better. This is probably preferable to a model in which many firms try to bring a complete brewery-to-supermarket product to market: this latter system duplicates effort, promotes potentially deleterious levels of competition, and is unlikely to lead to modular breakthroughs that can be used in a variety of settings. In a parallel-effort model, a firm that has an excellent pretreatment system but a rather poor approach to processing could exist alongside a firm with excellent downstream processing but terrible pretreatment and both companies could go out of business. In a more distributed model, they could license or sell their breakthroughs to one another and both could move forward, or at least the best overall approach could.[100] This more distributed model offers more informational value about what’s failing and succeeding. It also partitions disaster (as well as success, potentially). Consider how Novozymes sells enzymes to a variety of companies, many of which end up out of business because certain parts of their production process remain difficult or immature technologically. This state of affairs both imparts information about what technological bottlenecks are in a supply chain and also allows Novozymes to continue to develop their own technology and sell enzymes to the next generation of firms attempting to solve the bottlenecks. The presence of midstream firms can help avoid an investment winter. “A lot of cultured meat companies,” New Age Meats cofounder Brian Spears argues, “are… trying to be supermen, to do all the elements in-house, the cell lines, the cell culture, the scaffolding, and the bioreactors each of which is a multi-million dollar industry. But I think the industry will fail if it tries to do everything itself.”[101] Vince Sewalt (Senior Director of Product at DuPont Industrial Biosciences), quoting an old adage, echoes this sentiment: “Don’t do it alone... If you want to go fast, do it alone. If you want to last long, do it together.”

Jim Lane argues that “diversification beats a pivot every time… The great ones in the bioeconomy, they diversify, but they rarely abandon the field.” That is, rather than converting over their technical approach wholesale, companies ought to spread their effort and funding across multiple approaches and product types. “REG,” Lane continues, “has become a lot more than just biodiesel, but they were serious about their first business and serious about getting good at managing the cycle, not hopping elsewhere at the first sign of trouble. POET-DSM and Novozymes have been much the same — enter markets with purpose, then expand, rather than abandoning ship.”[102] In general, biofuel companies that successfully pivoted or diversified moved toward business-to-business sales and to higher-end, more niche products. In many cases (particularly for firms less established than REG and Novozymes), the revenue generated by newer, smaller-scale products make it possible for a firm to remain involved with its “first business.” (Although many companies, like Amyris, come to essentially abandon this first business.)

A final pragmatic note in favor of diversification within an industry: selling goods to customer-facing producers is often a better business model than becoming one. “As we can see with Novozymes, its [sic] a smoother road for the supplier companies than the producers,” Lane points out. “[A]s was discovered 160 years ago in the California Gold Rush by companies like Levi Strauss, you can mine the miners more reliably than the miners mine the gold.”[103]

Expectations grew rapidly, increasing pressure and risk.

As documented above, a sharp rise in expectations outstripped (by several orders of magnitude) the production capacity of firms like KiOR and Amyris. Often, promises and forecasts by these firms about their ability to scale and brings costs down drove these expectations.

Flynn, who previously worked in algal biofuels, argues that “consumer enthusiasm, government grants… basically set [algal biofuels] up to fail… You look at it from a perspective of ‘we have products that are worth thousands of dollars but we’re going to... make $2 per kilo biofuel’—why didn’t you make all those other products first?” The answer, Flynn argues, is poorly set priorities: “there was a whole lot of heat around the idea of carbon-negative fuel, so people went after” it instead of higher-margin products. Certain product choices (e.g. going for cheap fuel right out of the gate, when the technology was still immature) were like “setting the video game on the highest difficulty setting before you know the rules.”[104]

Vinod Khosla argued for the opposite approach, which in at least two cases (Amyris and KiOR) seemed to have turned out to be the wrong advice: “‘Set your sights on diesel,’ Khosla told the Amyris team, according to [early Amyris employee Jack] Newman. ‘It’s the hardest thing you’d want to do, but it’s the biggest market out there, and you’ll build an incredible company.’ Finding an alternative to petroleum had the same ring as battling malaria: The world would be better for it.”[105]

Even if a case existed in, say, 2013-2014 for increasing media attention to draw in cultured meat investment, the pendulum has since swung toward high levels of investment and attention. Few, if any, firms have failed to raise sufficient initial funding because levels of attention to cultured meat projects remain quite high. The case against hype is much stronger in 2019 than it was in the early 2010s.

Some firms drew on the same feedstock, correlating commodity risks.

Feedstock (e.g., corn, sugarcane, used cooking oil—the substances used to make biofuels) sharing exposes firms to a variety of risks. If the demand each firm has for feedstock now falls on the same supply, this exerts upward pressure on prices. Moreover, it means multiple firms (and their suppliers and consumers) are now at risk from supply disruptions in one feedstock. “Scale ruins relationships, when a feedstock is shared,” write the editors of Biofuels Digest.[106] For feedstock, a “system of fungibility is the dinosaur in the system. It is what links all the markets together and causes them all so much economic pain when rising demand for one leads to rising price for the other.”[107] For cultured meat, this represents a reason to be wary of multiple firms relying on the same input, e.g. a specific growth factor like fetal bovine serum.

Early promoters made claims on behalf of the technology that were unlikely to hold up.

As documented above, biofuel firms and supporters tended to make outsize claims on behalf of biofuels. It will surprise no one that this tendency is alive and well in cultured meat development. Cultured meat is predicted to improve nutrition, supplant factory farming, produce carbon-neutral food, transform global land, and so forth. Adam Flynn identifies the suggestion that cultured meat could be carbon-neutral or -negative[108] as an example of one such exaggeration. He points out that even though algal biofuels “were built on top of a photosynthetic process that [was] ultimately carbon negative,” producers were unable to make algae, which is “photosynthetic and carbon negative” to begin with, into a carbon-negative final product. It seems unlikely, then, that cultured meat, which is not built on a carbon-negative process, will be carbon neutral. Its early iterations in particular seem likely to produce large amounts of carbon (though not relative to factory farming[109]). Flynn argues that it is difficult to envision “a situation where you put... 100,000 tons of steak inside a warehouse environment and it’s not producing a ton of CO2.” Carbon-neutral or -negative cultured meat is not impossible, but it is, for the moment, unlikely (at least without extensive offsetting).

A further example comes in the form of cost and scale estimates. Flynn argues that lack of engineers in early stages is how firms arrive at unrealistic estimates of yields and eventual cost: “ultimately the goal here seems to be a steak or a chicken breast.... [but] you’re not trying to produce that. You’re... trying to produce a machine that produces that. And in that the biology is one small part.” The algal biofuels industry made too-optimistic estimates when “everything was led by biologists and… biological projections. And that’s why you had these projections in the late ’90s that said 100,000 liters of fuel per hectare per week. And in reality nobody [had] ever done better than... five thousand, ten thousand maybe. That’s what happens when the engineers get involved late.”

In Flynn’s view, many cultured meat firms “massively underestimat[e] the fact that you’re not building an animal, you’re building a machine. Engineers should be involved in the conversation from day one, and when they’re not, you’re going to find out that your projections don’t really line up and investors are going to be disappointed, next thing you know you’ve lost 100 billion dollars, and… you’ve made it harder” for firms that might attempt similar applications. A “Brazilian collagen company,” for example, “is not going to be able to raise money, even though it might be a very good sustainable business model, because everybody’s lost their shirt in the industry and it will be like 15 years before they’ll come back around. And we see that in algal biofuels too… and we’re going to see that bloodbath with some of [the cellular agriculture] companies.”[110]

Biofuel startups often hired many researchers but few operations experts.

The history of biofuels turns out to swing upon operational (and engineering) questions more than it does upon pure biology and chemistry. Firms were more likely to fail because they could not coordinate the logistics of plant construction than because the behavior of chemical bonds during pyrolysis was not well understood. KiOR, for example, hired “a relative preponderance of lab researchers with PhDs and a dearth of people with technical, operational experience running energy facilities,” reports Fehrenbacher, who cites Paul O’Connor as saying that the “lack of people with real operational experience ‘hurt KiOR a lot.’”[111] Later on, “The [KiOR] facility was bedeviled by production problems. The conveyor mechanism that delivered wood chips was often on the fritz. Cleaning systems routinely jammed with a tarlike substance. The company spent tens of millions of dollars more than it had expected, and its researcher-heavy staff couldn’t untangle the problems.”[112]

Shifts in commodity prices affected the viability of firms and their technologies.

Feedstock costs were a major determinant of the economic viability of biofuels. “Regardless of the production platform,” Karatzos et al. wrote in 2014, “the major interconnected parameters that are influencing the rate of commercialization of drop-in biofuels are capital and operating expenditures, process yields and productivities, and feedstock sourcing.”[113] Biofuel firm balance sheets often reflected insufficient tolerance for shifts in commodity prices. For example, crude oil dropped to $35 per barrel in 2015 from well over $100 in the five preceding years, sending several firms into a tailspin. Many biofuel companies had been planning to replace oil at $100 per barrel. The point at which their products would become price competitive had dropped by 60% in six months. Because cost reductions have a nonlinear relationship with scale,[114] hitting a $35/barrel price target was orders of magnitude more difficult than reaching a $100/barrel target. It took many firms’ to-market roadmap from “difficult, but doable in 18 months if everything goes right” to “maybe someday.”

Biofuel firms sometimes fell afoul of the “Natural Law of Alternative Commodity Markets,” which predicts that “no one will use a commodity to make another commodity of lower value.”[115] (Or, at least, not for long.) If bean oil is expensive and heating oil is cheap, for example, it is inadvisable to spend money and time to turn the first into the second. Cultured meat firms, at least in the current research stage, ignore the law of alternative commodity markets: it is common to use fetal bovine serum (anywhere from $200 to $1,200/liter) to make ground beef ($3.50/kg). (Note that fetal bovine serum is used as a research tool rather than a commercial ingredient, but the price difference gives some indication of the magnitude of the gap left to bridge.) It is important, therefore, to keep a close eye on commodity prices and to plan for scenarios in which input costs climb while prices for end products stagnate.

Many biofuel firms use a BOHO (bean oil-heating oil) spread index to track the price difference between bean oil and heating oil. A similar index of the spread between cultured meat inputs and outputs[116] is likely to shed light on the viability of cultured meat ventures and the economic competitiveness of a given technical path.